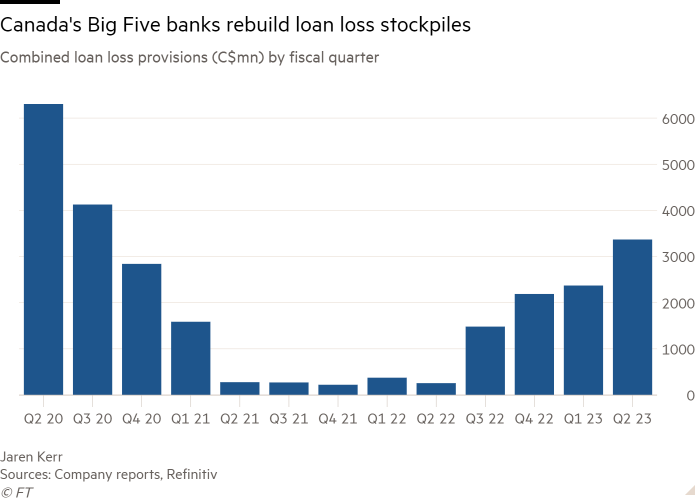

Canada’s big five banks this week collectively set aside the most money for loan losses since 2020, as concerns about an economic slowdown and higher defaults in commercial real estate mount.

The country’s top five lenders, which all reported earnings this week, logged a combined C$3.37bn (US$2.48bn) in credit loss provisions in the first three months of 2023, C$1bn more than the previous quarter and up almost 13-fold year on year.

“The higher provisions quarter-over-quarter [are] due to a more unfavorable macroeconomic outlook,” Phil Thomas, the Bank of Nova Scotia’s chief risk officer, said on the bank’s earnings call. “This is driven by our assumptions around the following potential headwinds: increased risk of a recession and a potentially more challenging credit cycle.”

All of the big Canadian banks singled out elevated risks in North America’s commercial real estate (CRE) sector as a reason for ratcheting up credit loss reserves. As more workers settled into remote or hybrid work during the pandemic, the demand for office space fell, putting pressure on office rents and valuations. At the same time, a surge in interest rates has pushed up debt servicing costs.

Royal Bank of Canada said its allowance for CRE credit losses had doubled compared with pre-pandemic levels, and TD Bank said its CRE reserves were 2.5 times higher than they were before the pandemic.

The banks struck a more confident tone when addressing their Canadian mortgage and personal loan portfolios, even though Canada’s housing agency had warned that the country has the highest household debt level of all G7 countries.

A wave of upcoming mortgage renewals at much higher interest rates is expected to add thousands of dollars to monthly mortgage costs in areas such as Toronto and Vancouver, where the average home cost is more than C$1.1mn.

“From a credit-quality perspective, the residential mortgages on Canadian banks’ books are very solid, and pretty recession proof,” said John Aiken, Barclays’ head of research in Canada. “The high loan-to-value mortgages — the ones theoretically at risk — are insured, and so the banks are basically bulletproof on that.”

Four of the big five banks missed analysts’ profit expectations as higher expenses and depressed revenues squeezed margins. Only Canadian Imperial Bank of Commerce, the fifth-largest lender, exceeded expectations. Overall, they fared worse than large banks in the US, which outperformed Wall Street’s profit forecasts, helped by higher borrowing costs, which padded net interest income and compensated for lower investment banking revenue.

For the Bank of Montreal and TD, which have substantial US businesses, their weaker than expected results were tied to US expansion plans. Integration costs from BMO’s purchase of California’s Bank of the West weighed on its earnings, and 92 per cent of its provisions on performing loans were inherited from the deal, pointing to greater credit risks south of the border. Meanwhile, TD cut its profit outlook, partly because of charges from its failed effort to buy US regional lender First Horizon.

Canada’s banking sector has historically been seen as safer and more lucrative than its US counterpart because of the dominance of a handful of large lenders. That impression was reinforced this year when the US regional banking sector was roiled by the collapses of Silicon Valley Bank and First Republic.

“Canadian banks generate higher [return on equity] and trade at higher book multiples than US banks,” wrote Nigel D’Souza and Roshan Paunikar, analysts at Toronto-based Veritas Investment Research. “Since 1840, Canada has not experienced a bank crisis, and only two banks have failed since 1923. . . The US banking system, on the other hand, has experienced 12 major banking crises since the 1840s.”

Aiken from Barclays said investors still reward Canadian banks that pursue international growth. Despite its swing and miss on the First Horizon acquisition, TD’s chief executive Bharat Masrani this week said it would continue to look at opportunities for deals. However, Aiken said Canada’s banks are not likely to pounce on distressed US lenders in periods of economic uncertainty.

“We have not seen the Canadian banks historically be opportunistic in times of crisis,” he said. “I think, in general, they prefer to have a lot better visibility in terms of the economic outlook.”