For most people, it makes sense to convert enough of your RRSP to a RRIF and claim the pension tax credit

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

By Julie Cazzin with Allan Norman

Advertisements 2

Article content

Q: I just turned 65 years of age and still work full time. To take advantage of the $2,000 pension tax credit, I need to convert at least some of my registered retirement savings plan (RRSP) into a registered retirement income fund (RRIF) so that I can withdraw $2,000 each December as qualifying pension income. My question is, if I set this up today, can I withdraw the $2,000 and claim it as qualifying retirement income for 2023? Also, my wife Dorothy is 63 years old. Can RRIF pension income be split with her? Or does she need to be 65 years of age? What’s the best way for me to take advantage of this tax credit for my wife and I at this point? — James S.

Article content

FP Answers: James, that’s a good question. I find there is some confusion around the pension tax credit. A lot of people think they should automatically convert all or some of their RRSP to a RRIF and draw $2,000 per year to claim the pension tax credit once they enter the year they turn 65. Some people even think claiming the pension tax credit is a way to get $2,000 out of their RRSP/RRIF tax free. Neither of these thoughts are necessarily correct. Let me quickly address your questions and then I’ll dive a little deeper into the pension tax credit.

Article content

Advertisements 3

Article content

You’re right, in the year you turn 65, you can claim the federal $2,000 pension tax credit even if you are still working. There is a list of what qualifies as retirement income, and RRIF income qualifies, which is the reason you want to convert some of your RRSP to a RRIF. I presume you are not converting all your RRSP holdings to a RRIF, because the minimum RRIF withdrawals will force you to draw more than $2,000 per year from your RRIF, which is more than what you can claim for the pension tax credit.

Your RRIF income can be split with your wife in the year you turn 65 even if Dorothy is not yet 65. The pension tax credit is non-refundable, meaning you can’t reduce your income below zero and expect to get a tax refund — it is non-refundable. You can, however, transfer all, or the unused portion, of the pension tax credit to your wife.

Advertisements 4

Article content

Unfortunately for you, James, your wife must be 65 in this case. Interestingly, there are qualifying pensions that do allow you to transfer the pension tax credit to a spouse under the age of 65, but RRIF income is not one of them.

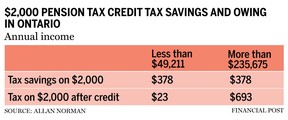

Now, the question is should you convert some of your RRSP to a RRIF and claim the pension tax credit? In Ontario, the tax savings is $378 no matter your tax bracket, high or low, which you can see in the accompanying table, along with the tax owing.

As you can see, there is very little tax owing to the lower income level when the combined federal and Ontario tax rate — 15 per cent and 5.05 per cent, respectively — is 20.05 per cent. The federal pension tax credit is calculated as 15 per cent of $2,000, or $300, which offsets the $300 of federal tax owed. In Ontario, the pension tax credit only applies to pension income up to $1,541, resulting in a credit of $78 (or 5.05 per cent of $1,541). You still have to pay provincial tax on the remaining $459 at 5.05 per cent, which comes to $23.

Advertisements 5

Article content

The same applies to people earning more than $235,675 per year, the highest tax bracket in Ontario, but the combined federal and provincial tax rate is 53.53 per cent, so high-income earners will have to pay some federal and provincial taxes on the $2,000 RRIF withdrawal.

James, I’m not sure what your current income is or how long you plan to keep working. No question, there are tax savings for you here. If I was to complicate this and look for reasons for you not to convert a portion of your RRSP to a RRIF, here are three of them:

Will you be in a lower tax bracket and pay less tax on the $2,000 RRIF withdrawal when you stop working?

Are you better off leaving the $2,000 in your RRSP so the compound investments are tax sheltered until you turn 72?

Advertisements 6

Article content

-

Is the conservative approach hurting investment returns?

-

What to look for when analyzing mining sector ETFs

-

What should this couple do with a $4.7-million lottery win?

Will there be an additional account fee if you open a RRIF account?

Fortunately, it doesn’t have to be that complicated when it comes to the pension tax credit. There is a small tax savings, and you are not going to make a major mistake no matter your decision, so go with your gut. For most people older than 65 without retirement income, it makes sense to convert enough of your RRSP to a RRIF and claim the pension tax credit.

Allan Norman provides fee-only certified financial planning services through Atlantis Financial Inc. and provides investment advisory services through Aligned Capital Partners Inc., which is regulated by the Investment Industry Regulatory Organization of Canada. Allan can be reached at [email protected]

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation