evandrorigon

A Quick Take On Unusual Machines

Unusual Machines, Inc. (UMAC) has filed to raise $10 million in an IPO of its common stock, according to an amended S-1/A registration statement.

The firm seeks to acquire the consumer drone and related products business from Red Cat Holdings, Inc. (RCAT).

Unusual Machines, Inc. has no meaningful operating history or revenue and is highly speculative, so I’ll pass on the IPO.

Unusual Machines Overview

San Juan, Puerto Rico-based Unusual Machines, Inc. was founded to acquire the consumer drone operations of Red Cat Holdings for $18 million in cash, a convertible note and issuance of the firm’s Series A convertible preferred stock.

Management is headed by Chairman and CEO Brandon Torres Declet, who has been with the firm since April 2022 and was previously CEO at AgEagle Aerial Systems (UAVS) and prior to that founded Measure UAS.

The company’s primary offerings will include the following:

Fat Shark – FPV goggles

Rotor Riot – drones.

As of December 31, 2022, Unusual Machines has booked a fair market value investment of $4.7 million from investors including Jeffrey Thompson, Gordon Holmes, Michael Laughlin and Eleven Ventures.

The company will seek to develop and sell Fat Shark and Rotor Riot first-person view [FPV] goggle technologies and drones to businesses and consumers.

The firm will also pursue an acquisition strategy as needed to speed its go-to-market efforts and expand its technology or distribution capabilities.

Unusual Machines’ Market & Competition

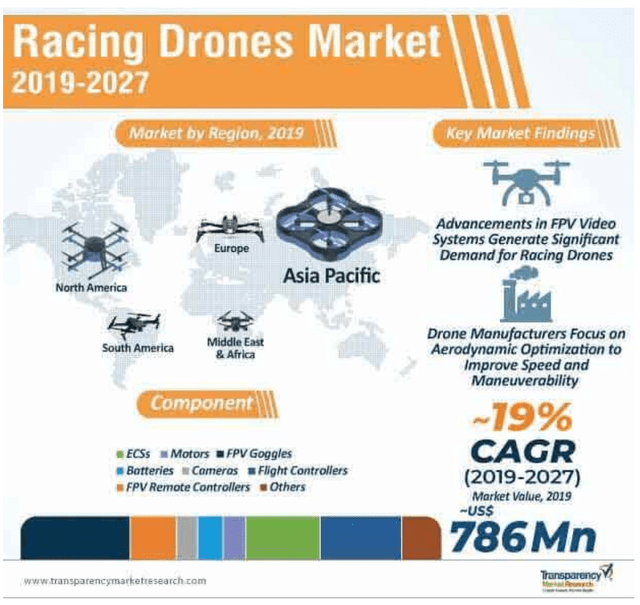

According to a 2020 market research report by Transparency Market Research, the global market for FPV and racing drones was an estimated $786 million in 2019 and is forecast to reach $3.2 billion by 2027.

This represents a forecast for a robust CAGR of 19% from 2019 to 2027.

The main drivers for this expected growth are a sharp rise in the number of casual drone users, advancements in drone technologies and the inception of several drone racing leagues worldwide.

Also, the chart below summarizes various aspects of the market dynamics:

Racing Drone Market (Transparency Market Research)

Major competitive or other industry participants include the following:

SZ DJI

T-Motor

Samsung

Sony

LG Electronics

htc

Lenovo

eps

Yuneec

Boscam

Eachine

Walkera

SkyZone

MicroLED

Others.

Unusual Machines, Inc. Financial Performance

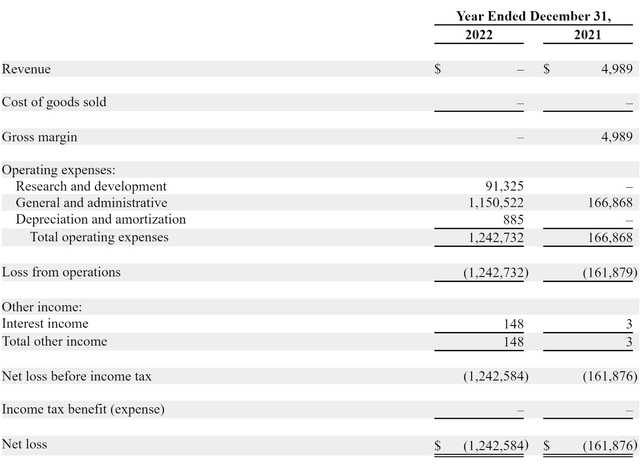

Below are relevant financial results derived from the firm’s registration statement:

Statement Of Operations (SEC)

(Source – SEC.)

As of December 31, 2022, Unusual Machines had $3.1 million in cash and $120,938 in total liabilities.

Unusual Machines IPO Details

Unusual Machines, Inc. intends to sell 2.0 million shares of common stock at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $10.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $23.2 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 28.92%. A figure below 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

The firm is an “emerging growth company” as defined by the 2012 JOBS Act and has been elected to take advantage of reduced public company reporting requirements; prospective shareholders will receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

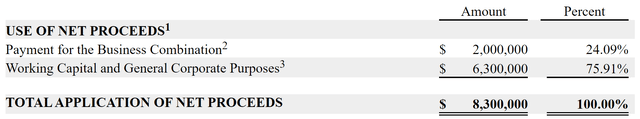

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Proposed Use Of IPO Proceeds (SEC)

(Source – SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party to any litigation, and neither are the proposed acquisition targets for Fat Shark or Rotor Riot.

Listed underwriters of the IPO are ThinkEquity and Dominari Securities.

Commentary About Unusual Machines

Unusual Machines, Inc. is seeking US public capital market investment to fund the acquisition of Red Cat’s consumer drone segment.

The company has no real operating history, although senior management does have experience in the industry.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the firm’s growth initiatives and working capital requirements.

The market opportunity for FPV and racing drones is moderate and is expected to grow at a relatively high rate of growth in the coming years, so the company has industry growth dynamics in its favour.

ThinkEquity is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (60.2%) since their IPO. This is a bottom-tier performance for all significant underwriters during the period.

Risks to the company’s outlook as a public company include its thin capitalization and the possible need for additional investment to execute on its business plan.

As for valuation expectations, management is asking IPO investors to pay an Enterprise Value of approximately $23 million.

It is unusual to have a company seek to IPO for the sole purpose of acquiring its initial set of assets.

Due to the highly speculative nature of Unusual Machines, Inc. and its lack of operating history, I’ll pass on the IPO.

Expected IPO Pricing Date: To be announced

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.