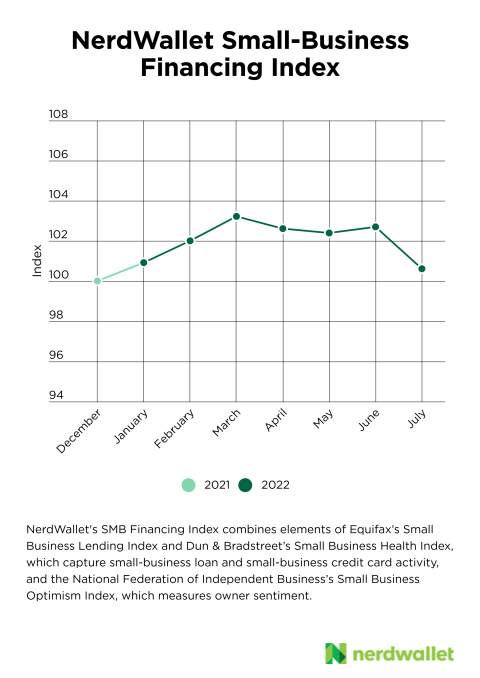

Rising charges of curiosity and uncertain monetary circumstances are intensifying a slowdown in financing-related train amongst small corporations, based mostly on the newest launch of the NerdWallet Small-Enterprise Financing Index.

The NerdWallet Small-Enterprise Financing Index evaluates components harking back to mortgage delinquency prices, mortgage volumes, financial institution card use and optimism amongst small-business householders. Based mostly totally on the newest obtainable info, from July, the index now sits at a low of 100.6, better than two components beneath its March 2022 extreme of 103.2.

The index had been comparatively flat over the previous couple of months, indicating that financing-related train had been holding common; nonetheless, July’s downturn suggests the dam may need burst.

Index values for December by way of April have been revised to reflect interpretive modifications in info assortment from a provide. You may discover the prior values in our earlier NerdWallet Small-Enterprise Index.

Key indicators slide

Declines in small-business lending and stagnating optimism amongst small-business householders helped push the index lower, based mostly on underlying info from Equifax, the Nationwide Federation of Neutral Corporations, and Dun & Bradstreet.

In July, small-business mortgage amount was at its lowest stage since late 2020, based mostly on Equifax.

Data on small-business financial institution playing cards and mortgage delinquencies was blended, with Equifax reporting rising delinquency prices in eight of the ten largest states and in all six of its tracked industries in July; Dun & Bradstreet, nonetheless, reported decreases in value delinquencies and financial institution card delinquencies amongst small corporations.

Optimism measures from the Nationwide Federation of Neutral Corporations continued to fall, with the commerce group reporting that capital spending plans, inventory funding plans, anticipated precise product sales and the environment for rising have all come down.

Lending circumstances anticipated to toughen for small corporations

“We’re in that part of the cycle the place credit score rating availability goes to get tighter,” says Tommy Thompson, a licensed financial planner at Fashionable Financial Group in Alpharetta, Georgia. The reality that loads of small-business lending is short-term in nature and typically contains floating charges of curiosity might make rising charges of curiosity way more tough for small corporations that need capital, he offers.

“It’s going to worth additional to get credit score rating,” he says. “Underwriting necessities are going to get extra sturdy because of you will actually start seeing delinquencies and defaults, and the banks don’t reply to that by going, ‘Oh, we have to be looser with our money.’ They reply to that with tightening up their underwriting requirements.”

Consultants say: Do these 5 points to get larger prices from enterprise lenders

A extra sturdy lending environment means enterprise loans will seemingly embrace bigger price tags inside the coming months, nonetheless small-business professionals say there are points entrepreneurs can do correct now to get lower charges of curiosity on enterprise loans.

1. Have a relationship with the lender

In the event you should not have an present relationship with a lender, now may be a good time to make one. Thompson signifies that connecting with an space banker who has some autonomy inside the underwriting course of might make the entire distinction all through a superb credit score rating market.

“They know what their underwriters are looking out for, and so they’ll do the instructing with the enterprise proprietor to make sure that the steadiness sheet appears the best way wherein it should look,” he says. A neighborhood banker may additionally take a look at credit score rating critiques and price histories ahead of time to confirm there are no purple flags in your utility.

2. Consider using collateral

Collateral reduces the lender’s risk, which can suggest a better deal for the borrower, based mostly on Kelly Crane, a licensed financial planner and senior vp at Wealth Enhancement Group in St. Helen, California.

From a lender’s perspective, Crane says, “securing the mortgage merely with what you might be selling earnings is riskier than having it secured by an asset like your setting up or your individual house. So collateralized loans typically have lower prices.”

3. Get your books up to date

If you would like probably the greatest phrases on a enterprise mortgage, be sure that what you might be selling’s accounting statements and tax returns are applicable, full and current, says Armine Alajian, a licensed public accountant and founder on the Alajian Group in Los Angeles and New York.

You’ll have to have the flexibility to make clear to lenders what each line merchandise means in your financial statements and what story that tells. You additionally must be able to make clear how the info in your tax returns ties to the info in your accounting statements, she says. “They ask loads of questions,” Alajian offers.

4. Protect your personal credit score rating ranking extreme

A personal FICO ranking over 720 is a will need to have for getting probably the greatest charges of curiosity from small-business lenders, Crane says.

“There’s a in depth spectrum of corporations, from the one proprietor attempting to fund his private operation to at least one factor barely bigger than that,” he says. “Throughout the smaller of those enterprise environments, it’s truly primarily based totally on the proprietor’s credit score rating.”

In the event you should assemble your credit score rating, monitoring your FICO ranking, freezing your credit score rating report again to thwart hackers and signing up for account alerts might help, based mostly on Crane.

5. Retailer spherical and look at your decisions

It’s laborious to know in case you are getting probably the greatest deal besides you may need one factor to match it to, Crane notes.

“The one resolution to validate the costs you might be being charged is to talk to a distinct lender,” Crane says. “If in case you’ve the flexibleness to talk to 2 utterly totally different banks and endure the tactic, I would say do your homework and be eager to spend that time sooner than you need the mortgage.”

Methodology

That’s the second installment of the NerdWallet Small-Enterprise Financing Index. It tracks and weights info from quite a lot of sources, beginning in December 2021. Future index readings are always relative to the preliminary entry of 100. As an illustration, an index finding out of 110 would level out that the index has risen by 10% since December 2021. Monitoring this info offers a continuing glimpse into the monetary context throughout which small corporations operate.

NerdWallet’s Small-Enterprise Financing Index combines elements of Equifax’s Small Enterprise Lending Index and Dun & Bradstreet’s Small Enterprise Properly being Index, which captures small-business loans and small-business financial institution card train, along with the Nationwide Federation of Neutral Enterprise’s Small Enterprise Optimism Index , which measures proprietor sentiment.

Index values for December by way of April have been revised to reflect interpretive modifications in info assortment from a provide. You may discover the prior values in our earlier NerdWallet Small-Enterprise Index.

Additional From NerdWallet

Tina Orem writes for NerdWallet. Piece of email: [email protected].

The article Small-Enterprise Lending Slows, Prices Rise: Right here is What You Can Do initially appeared on NerdWallet.