Roughly two-thirds of retail bank customers ‘financially unhealthy,’ the study finds

Article content

As high inflation, rising interest rates and market volatility take a toll on their finances, Canadians are seeking advice from their financial institutions, but some banks are not delivering this effectively, according to a new study.

Advertisements 2

Article content

Article content

The JD Power 2023 Canada Retail Banking Advice Satisfaction Study, which interviewed 2,911 retail bank customers, classified roughly two-thirds of them as “financially unhealthy.” Yet just 42 per cent of customers said they received advice from their bank, and only half of them found advice to be helpful. As a result, overall satisfaction with banking advice declined four points from last year to 588 on the 1,000-point scale.

“During times of financial hardship, customers are looking for guidance,” Jennifer White, senior director for banking and payments intelligence at JD Power, said in a press release. “Canada’s large banks should be more attuned to their customers’ financial state and needs, offering and tailoring advice that is aligned with their financial challenges and tied to their future financial goals.”

Advertisements 3

Article content

The top three key performance indicators for customer satisfaction all focus on personalized advice: the advice completely meets the customer’s needs; the bank representative shows genuine care for the customer’s concerns; and the advice is highly tailored to the individual. Satisfaction levels increased more than 200 points when any of the three were met.

The Royal Bank of Canada ranked highest in customer satisfaction for the third year in a row with a score of 610. The Bank of Montreal came in second at 592 and the Canadian Imperial Bank of Commerce followed closely behind at 591.

“Delivering advice can increase customer trust by nine percentage points, and when the advice is completely personalized, trust rises by 15 percentage points,” White said. “Unlike their US counterparts that demonstrated an improvement on that front, Canadian banks have yet to rise to the occasion and are still lagging in delivering the right advice at the right time to make a positive impact on their customers’ satisfaction.”

Article content

Advertisements 4

Article content

The study said customers’ financial state is also tied to their satisfaction levels. “Financially healthy” customers reported significantly higher satisfaction with their bank’s advice (657) than those who are considered “financially stressed” (562) or “vulnerable” (500).

Bank customers most often seek and receive advice on investments and retirement, and interest is on the rise.

But financial advice isn’t the only reason Canadians are dissatisfied with their banks. A separate study by Harbourfront Wealth Management Inc. said 24 per cent of Canadians believe their financial institution does not give them access to all types of investment products and a further 27 per cent feel they do not have access to every type of investment product they want.

Advertisements 5

Article content

As a result, 42 per cent of them are open to using another financial institution and 43 per cent are open to using another investment adviser to gain better access to these products.

“We’re advocates of empowering Canadians to become more financially independent,” Christine Tessier, chief investment officer at Harbourfront, said in a press release. “Canadians want more institutional-grade quality opportunities — and they’re willing to make the switch to get it.”

Posthaste will return on Tuesday, July 4, after the Canada Day holiday.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

Advertisements 6

Article content

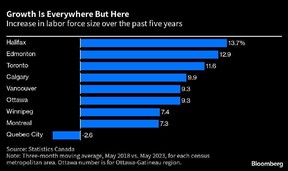

Businesses around the world are looking for workers, but they’re another level of desperate in Quebec City. The local unemployment rate hovers around 2.5 per cent, near the lowest of any North American city of over 500,000 people.

Prime Minister Justin Trudeau has thrown open the doors wide to newcomers, boosting Canada’s immigration targets and giving the country the fastest population growth among advanced economies.

They mostly stay away from the French-speaking Quebec City area, however. The region received less than 20,000 immigrants over the past six years. Montreal’s metropolitan area, which is about five times larger by population, has received 12 times as many immigrants. —Bloomberg

___________________________________________________

Advertisements 7

Article content

- Today’s data: Canadian monthly real GDP, Bank of Canada business outlook survey and survey of consumer expectations; US personal income and consumption, Chicago PMI, University of Michigan consumer sentiment index.

___________________________________________________

_______________________________________________________

____________________________________________________

As more financial institutions roll out the first tax-free home savings account (FHSA) offerings in the months ahead, Canadians who are considering opening such an account should pay close attention to the qualifying rules, especially if they are considering moving in with a partner who may already own their own home. Tax expert Jamie Golombek has a quick refresher of the FHSA basics. Read it here.

Advertisements 8

Article content

-

3 pitfalls to avoid when trying to improve your credit score

-

How to solve Canada’s slow-moving retirement crisis

-

Is retirement still possible after a costly divorce at age 61?

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected], or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episodes below:

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation