After a string of lackluster results, investors may rethink their blind faith in the sector

Article content

Canadian bank stocks have earned a reputation for being outperformers over the years, but a string of lackluster showings may have some investors rethinking their blind faith in the sector.

Advertisements 2

Article content

Last year was the fourth time in the past five years that the big banks have lagged the S&P/TSX Composite Index in price performance (not including dividends), but only the eighth time since 2000.

Article content

Shares of the Big Six banks slumped by an average of 13.6 per cent in 2022, worse than the S&P/TSX’s loss of 8.7 per cent, according to a Jan. 4 notes from Canaccord Genuity analyst Scott Chan.

The Royal Bank of Canada fared the best, dropping just 5.2 per cent while the Bank of Nova Scotia fell the furthest, shedding 25.9 per cent.

The year was tough on the banks, as rising rates weighed on the demand for borrowing. Then a second-half rally that has often padded their returns failed to materialize, according to National Bank of Canada analyst Gabriel Dechaine.

Advertisements 3

Article content

“The Big Six didn’t deliver the second-half rally they usually provide,” Dechaine wrote in a Dec. 19 note to clients, observing that it was the first second-half underperformance since 2019 and only the sixth since 2000.

Chan noted that 2021, when the COVID rebound led to strong gains, is now the only year over the past five in which the banks have beat the index. That 12.3 per cent outperformance came after they underperformed by 0.4 per cent, seven per cent and 3.8 per cent in the years between 2018-2020.

National Bank’s Dechaine said a cooling housing market and shifting credit cycle were headwinds for the banks last year, factors that he expected to remain challenging in the months ahead. He argued that housing could be the most powerful sentiment driver in space.

Advertisements 4

Article content

“This theme is hardly unique to 2023, as there seem to be concerns related to Canada’s housing market every year,” Dechaine said. “Except, somehow, this year feels different and that’s partly because the era of cheap money may finally be over. If it is, Canadians are facing pretty steep payment shocks over the next several years when they refinance their mortgages.”

Other themes expected to dominate the banking space in 2023 included monetary policy, with the Bank of Canada nearing the tail-end of its most aggressive rate hiking cycle, and capital requirements, with concerns the Office of the Superintendent of Financial Institutions could raise the domestic stability buffer yet again.

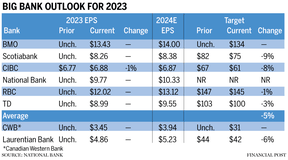

As a result of those ongoing challenges, Dechaine revised his target price for the Big Six banks (he does not follow his own institution, National Bank) down five per cent on average for this year.

Advertisements 5

Article content

RBC is currently the only one he has rated outperform, but he acknowledged that this view could change if valuations start to reflect a greater downside, if central banks pivot and if the outlook for the credit cycle becomes clearer.

Canadian bank stocks are high quality, they pay really, really good dividend yields

Canaccord Genuity analyst Scott Chan

On the bright side, Chan’s data showed that the bank stocks’ recent rough patch had followed seven straight years of outperformance, and he further observed that the banks have kept ahead of the TSX over longer horizons.

He also suggested there may be room for investors to maneuver and position themselves in banks.

In his note, he borrowed from the “Dogs of the Dow” playbook, an investment strategy that suggests buying the worst performing stocks in the Dow Jones Industrial Average from the previous year in the hopes they will revert to the mean.

Advertisements 6

Article content

Adapted to the banks, that would mean going overweight Scotiabank, which had the lowest price return in 2022, and underweighting the top performer, RBC.

Canaccord Genuity’s research showed this strategy has been played out successfully in 22 out of the past 37 years. conversely, buying the previous year’s winner has panned out 14 of 24 years.

Chan argued that the bank stocks were still a fundamentally strong play over the long term with diversified businesses and dividend yields; it’s just a matter of getting past the current downturn in the sector.

“Canadian bank stocks are high quality, they pay really, really good dividend yields,” Chan said in an interview.

“I would say at this standpoint, the banks feel pretty comfortable about credit,” he continued. “I feel pretty comfortable as well. But that could change with geopolitical events and unforeseen stuff that happened in (the first quarter of 2022).”

• Email: [email protected] | Twitter: StephHughes95