Tupperware, the US maker of food storage containers, has warned that it could go bust unless it can quickly raise new financing.

The 77-year-old firm said there was “substantial doubt about its ability to continue as a going concern”.

Tupperware has been trying to reposition itself for a younger audience but has failed to stop a slide in its sales.

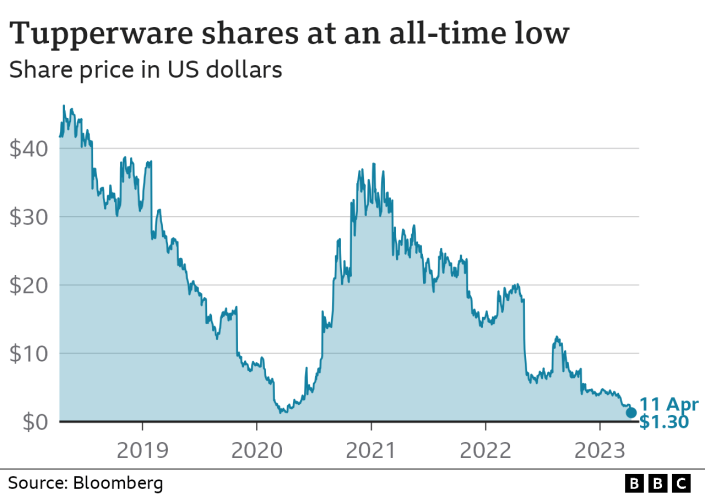

Its shares plunged nearly 50% on Monday before recovering slightly on Tuesday.

The firm became well-known in the 1950s and 1960s when people held “Tupperware parties” in their homes to sell plastic containers for food storage.

Tupperware still employs a direct sales force – who earns a percentage of all the goods they sell – as well as selling goods on its website.

It recently started selling its products in US retail chain Target in an attempt to entice younger shoppers as well as to other retailers around the world.

It has also expanded its range into cooking products, such as a grill that works in a microwave.

At the time, Miguel Fernandez, Tupperware’s chief executive – its third in five years – said he imagined the grill “for someone who lives in an apartment in New York City and you can’t really do outdoor grilling but you can use this”.

However, Neil Saunders, managing director of retail at the consultancy GlobalData, said Tupperware has “failed to change with the times in terms of its products and distribution”.

He said that the method of selling directly to younger customers through Tupperware parties “was not connecting” and that even older customers who “remembered Tupperware on its heyday” had moved on – customers can now buy cheaper or more fashionable containers in shops or online.

Meanwhile, Tupperware said in March that its workforce of direct sellers would have shrunk by 18% in 2022 compared to the previous year. It was also impacted by Covid lockdowns in China which hit consumer access to products.

Mr Saunders also said that Tupperware – while considered innovative many years ago – was perhaps not as inventive and stylish as other brands such as Joseph Joseph, the home goods design company started by twin brothers Antony and Richard Joseph.

Younger customers have also embraced more environmentally-friendly products such as beeswax paper to keep food fresh which can be used again and again, he said.

Tupperware had seen a resurgence during the Covid pandemic as people cooked for themselves at home and its share price surged, but sales have slid since then.

In a statement, Tupperware said that its shares were in danger of being delisted from the New York Stock Exchange because it had not yet filed its annual report.

It also warned that it had to renegotiate its loans after already amending its loan agreements three times since August 2022.

Tupperware said it was struggling with higher interest costs on its borrowings while it was trying to turn the business around.

The company said it “currently forecasts that it may not have adequate liquidity in the near term”, adding that it “has therefore concluded that there is substantial doubt about its ability to continue as a going concern”.

Just a month ago, Tupperware’s chief financial officer Mariela Matute, who joined the company in May last year, told investors: “We’re confident that we will be able to operate without substantial doubt in 2023.”

In addition, Tupperware said that its financial results for 2021 and 2022 as well as its interim figures in 2021 and the first three months of 2022 had been “misstated” due to how the firm accounted for taxes and leases.

Tupperware’s share price rose by 5.6% on Tuesday after dropping by nearly 50% on Monday.

The company said it was working with financial advisers to secure more money and investment. It is also checking whether it can sell property and cut jobs.

Mr Saunders said it was doubtful whether Tupperware could do enough now to turn itself around. He said that if the company had made changes 10 years ago, such as selling in shops or through wholesale, it might now be in a different position.

However, the brand name was still well-known, he said, and the company could appeal to a retail giant such as Walmart – which Asda used to own – or even Amazon.

Tupperware was founded by Earl Tupper, an American chemist, in 1946.

The polyethylene air-tight and water-tight products – with their double-sealed lid – were sold in department stores but were not immediately successful because potential customers were not sure how to use them.

People were used to glass and ceramic products and the new Tupperware container had to be “burped” to expel air when being sealed.

A saleswoman called Brownie Wise – who was already selling cleaning products door-to-door at home parties – started selling Tupperware herself.

She used home demonstrations to find customers and recruited other salespeople to sell the goods.

She was recruited as a vice president of marketing at Tupperware by Mr Tupper, helping to fuel growth at the business through parties which also allowed women to earn an income.

However, the founder and his vice president reportedly clashed over strategy and in 1958, Mr Tupper fired Mrs Wise. She sued the company and won a year’s salary. Mr. Tupper went on to sell the business.